The last few months have left B2B companies scrambling — but as all 50 states start to reopen, we are starting to see some return to normalcy.

Two weeks ago, we covered how the reopening of manufacturing impacted B2B advertisers. And last week, we shared which B2B categories that initially shot up in the pandemic are now back to normal.

Every day, it feels like there could be something new happening in the B2B space. Here we share the biggest changes we saw in B2B advertising during May.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

The state of B2B advertising in may

B2B websites saw a 17% MoM increase in the number of advertisers running ads on their sites in May.

This is a hopeful number considering that roughly 8% fewer companies were placing digital ads on B2B websites initially. As the economy reopens, it seems that advertisers are beginning to stabilize.

Meanwhile, print was down by roughly 20%. Some of this is due to temporary reductions in printing frequency amid the pandemic.

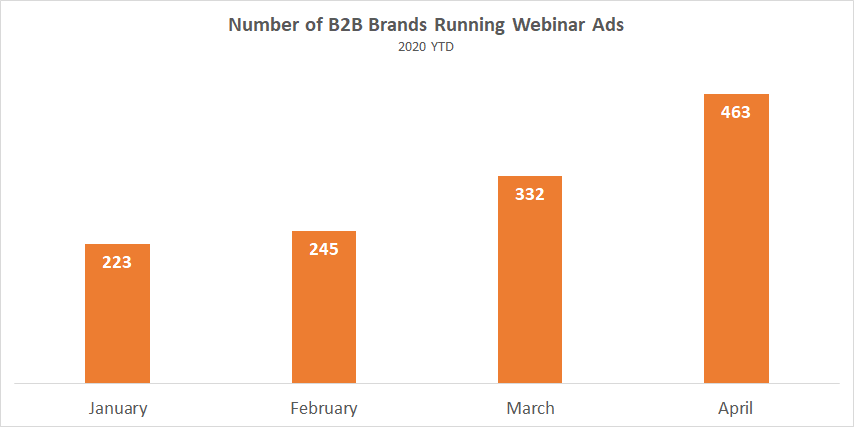

The rise in webinars has been the hallmark of B2B marketing during this pandemic. As B2B marketing leader Jay Hinman puts it, we are in the “current golden age of online, digital-only events.”

In May, 14% more companies ran webinar ads than in April.

Webinar advertisements have been increasing consistently, but which brands are shaking things up?

Who were the main movers last month?

When we look at the industries driving the increase in digital ad investment, there are some categories that stand out. Here’s what MediaRadar data shows.

Professional Service Firms

Professional service firms saw an 18% MoM increase.

Some of the sub-categories increasing spend the most include:

- Accounting/Financial Consulting

- Healthcare consulting

- Market Research Firms

- SEO Firms

One surprise was that conference and event spending began to bounce back. Spend was up 57% in May MoM, after steep cuts in April.

We may not know when in-person conferences will become a reality, but ads are picking back up.

Finance and Tech

Finance & Tech are two of the largest B2B advertisers. Their spending remained flat MoM in May, but despite the stable spending there were subcategories that stood out.

Within smaller subcategories these were the significant changes:

- Investment Services (+ 30% MoM)

- Insurance (+85%)

- Asset Management ( +133% MoM)

In Tech, these were the trends that stood out:

- Cloud Computing (+176%)

- Network Equipment (+16%)

- Anti-Virus/Malware Software (+377%)

As many companies won’t return to traditional offices this year, they’re continuing to make remote work sustainable and secure for large teams. Companies that facilitate that form of digital transformation seem eager to get in front of B2B decision makers.

Even though our day-to-day may feel the same, data reveals that changes are happening. We will continue to monitor the ad spend amid the transition to an ‘open’ society in a pandemic.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.